TPTW – TPT Global Tech

Technology is ever changing, but the quantum leap is in the making…..

TPTW has made two extremely important moves the past few months that, layered on top of the plans laid out in the latest Share Holder letter…. have a seat…. we are about to witness history.

TPTW recently completed the purchase of the technology and intellectual property of Lion Universe Technologies www.lionuniverse.com, a Los Angeles-based Mobile Technology think tank.

The Lion smartphone is the first Full HD Naked Eye 3D smartphone ever launched in the United States. Lion Universe mobile 3D technology is patent pending.

The smartphone will be distributed through TPT Global Tech's wholly owned subsidiary K-TEL's existing brick and mortar distribution channel in the Northwest and very soon a National and International roll out. TPTW is building industry leading personal cellular phones designed for a wide appeal. With a business model built on innovation and progress starting with the Lion Phone technology, the company produces high-quality and easy-to-use cellular phones.

The Lion Phone was designed for consumers looking for portable and affordable cutting-edge technology. The Company's first-generation phones come equipped with full high definition resolution screen for better viewing. This Full HD Naked Eye 3D smartphone is perfect for watching movies, playing games, even editing photos or videos.

Performance and Portability

Whether it's looking at photos, playing music, emailing or surfing the web, consumers want more from their phones. The Lion Phone raises the bar for cellular phones. For the first time ever, cellular users can enjoy quality 3D viewing with the naked eye, no glasses required, enjoying full high definition video with smooth playback.

"Consumers have been waiting for a way to watch their favorite movies in 3D, now they can watch them in the convenience of their phone and Gamers can have the leisure of playing their games without taking all that head gear with them," said Enoch Brande, President of New Product Development, Lion Universe Technology. "Throughout our company, we strive to give customers the best possible experience with our Full HD Naked Eye 3D smartphone in the US and Global markets. "

TPTW added the patent pending Full HD Naked Eye 3D smartphone hardware technology to theirportfolios of companies. This acquisition continues their commitment in moving TPT Global Tech into the Global Mobile Digital Media Technology space.

9 Days later, the company begins to utilize the newly formed relationship with AT&T.

TPTW added the patent pending Full HD Naked Eye 3D smartphone hardware technology to theirportfolios of companies. This acquisition continues their commitment in moving TPT Global Tech into the Global Mobile Digital Media Technology space.

TPTW's Arizona based wholly owned subsidiary CLEC Trucom recently completed its AT&T Mobility wireless certification. Trucom is now positioned to launch Trucom Wireless and Broadband Services Nationally with its strategic partner AT&T, utilizing AT&T's mobility 4G and 5G National network.

TruCom (www.trucom.com) is a Facilities Based Competitive Local Exchange Carrier (CLEC) headquartered in Phoenix, AZ. Founded in 2006 for the purpose of operating a state-of-the-art Fiber Optic Network, Trucom operates its own carrier class Fiber Optic Network, state-of-the-art Wireless Point-to-Point network, and Patent Pending proprietary "Bulletproof™" technology seamlessly integrating the two.

TruCom offers Phone, Internet, Fiber Optic, Wireless, Hosted PBX, Wi-Fi, Wi-Max, Engineering, Cabling, Wiring and Cloud services. With a penchant for pushing the envelope, TruCom has pioneered innovative, hosted firewall and managed MPLS service technologies (SuperCore MPLS™) and was the Industry first to engineer patent-pending failover services utilizing our own fiber optic and wireless networks to guarantee business continuity and service uptime.

Co-located in multiple Local Serving Offices and Points of Presence (POP's) in the primary Data Centers in the market, TruCom's extensive Fiber Optic Network runs through the heart of the most densely populated corridors of the Greater Phoenix Metro Area. Their Wireless Point to Point and Point to Multipoint Network is fed by the infinitely scalable capacity of the Fiber Optic Network and consists of more than 16 Major Access Points.

"We here at TPT Global Tech are very pleased to add the patent pending Full HD Naked Eye 3D smartphone hardware technology to our portfolios of companies. This acquisition continues our commitment in moving TPT Global Tech into the Global Mobile Digital Media Technology space. We also look forward to continuing our working relationship with Linda Kelly who will continue to head Lion Phone division as its CEO and her outstanding tech team moving forward," said Stephen Thomas, CEO of TPT Global Tech Inc.

A few important points to keep in mind about TPTW:

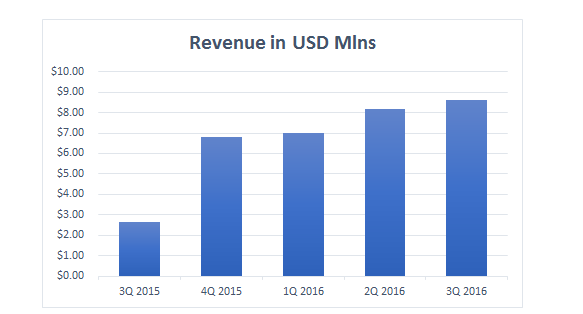

- TPTW reported over $2Mill in Revs for 2016

- TPTW already showed over $700K in revs for Q1 of 2017

- TPTW is sporting a TINY FLOAT of only 4.4Mill shares

So, now that we have a very interesting picture of TPTW's future direction, and the fact that last time we discussed the chart and letter of share holders, we witnessed a 600% uptrend over the next thre days….this should be interesting.

Please start your research on TPTW right away and enjoy.

Disclaimer:

We have received five thousand dollars via a bank wire for the awareness of TPTW.

All of the information in this blog is gathered from public information released by the company.

By reading our newsletter you agree to the terms of our disclaimer, which are subject to change at any time. Owners and affiliates are not registered or licensed in any jurisdiction whatsoever to provide financial advice or anything of an advisory nature. Always do your own research and/or consult with an investment professional before investing. Low priced stocks are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service, you agree not to hold us, our editor's, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters, website, twitter, Facebook and chat. We do not advise any reader take any specific action. Our website, newsletter, twitter, Facebook and chat are for informational and educational purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter, twitter, Facebook and on our website, may be based on EOD or intraday data. We may be compensated for the production, release and awareness of this newsletter. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. Our emails may contain Forward Looking Statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters, twitter, Facebook our website and chat is believed to be accurate and correct, but has not been independently verified. The information in our disclaimers is subject to change at any time without notice.

We are not held liable or responsible for the information in press releases issued by the companies discussed in these email's. Please do your own due diligence.

You know when the nation starts paying attention to lottery jackpots, right?

You know when the nation starts paying attention to lottery jackpots, right?

Don't forget, Bingo Nation is exclusively catering to Indian casinos. For good reason — they make up the largest gambling segment in America.

Don't forget, Bingo Nation is exclusively catering to Indian casinos. For good reason — they make up the largest gambling segment in America.