MOLOF – Molori Energy Inc.

Alright folks, here's the deal… Today's alert could become our BIGGEST RIPPER yet this week as we aim to go 3-0 on winning alerts with MOLOF! Strap in and get focused, because you might be witness to a lightning bolt today at the opening bell!

If you didn't know, President Trump has had a PRO gas and oil agenda since he has taken office as he desires to push the U.S. towards a point of global dominance in the energy arena.

Another OVERSOLD indicator we can look at is the Williams %R. Barchart also tells us that MOLOF's 9-Day %R is at a silly oversold level of 99.51%!

(I am not guaranteeing that MOLOF will go flying to any previous high or beyond. To do so, would be irresponsible. Simply, I want you to be aware of MOLOF's potential upside through a thorough study of its technicals and chart.)

MOLOF could be a bouncer as it has on many occasions over the past year… Where could tomorrow's potential bounce take us?!?!

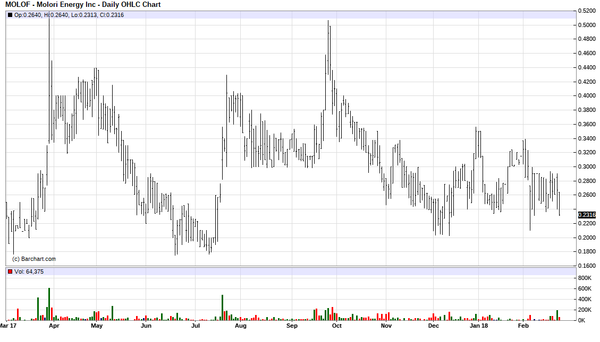

Take a close look at MOLOF'S CHART below immediately:

Do you see those short-term runs? Crazy, right? This play is an oversold ticking time bomb!

All you need to look at are a couple key ingredients to understand why this pick could be explosive! Study all of the OVERSOLD indicators like MOLOF's RSI and Williams %R, along with its chart history, and be prepared at tomorrow's bell!

Could this bounce play lead to our third consecutive win this week? I wouldn't bring this alert to your attention if I didn't think it had tremendous potential upside like my previous two runners!

More About (MOLOF)

?

Today, the Company has 165 producing (PDP) wells and an inventory of approximately 202 non-producing wells (PDNP) for a total of 367 wells. The Company will RTP ("Return To Production") the PDNP wells by performing simple re-works or re-completions which will include among other actions: replacing broken rods/tubing, steaming paraffin, performing chemical and acid treatments, repairing mechanical issues on pumpjacks, repairing flowlines, and repairing electricity and salt water disposal infrastructure. As a result, the Company has realized an average workover expense per well of approximately USD $12,000. These RTPs have demonstrated average production increases of 2.4 boepd/PDNP, resulting in an average cost per flowing bbl of USD $5,000/flowing BBL. When the assets were acquired in June 2016, the aggregate 8/8ths production was 40 BOEPD. As of February 2017, production increased to 435 BOEPD through the RTP program and acquisitions.

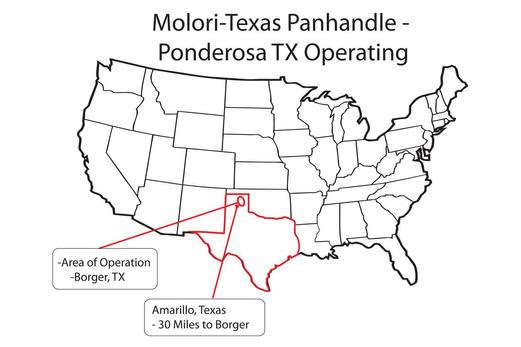

The assets include low-decline, PDP weighted reserves primarily in the West Panhandle Field of the Hugoton Basin of Texas. The assets are approximately 50% oil and 50% liquid rich gas (HIGH BTU premium gas) primarily located in Carson, Gray, and Hutchinson Counties of District 10.

Working Interest Partners

In summary, the initial projected average production was 40 barrels of oil equivalent per day ("BOEPD")* in June 2016, when Molori made its first investment into Ponderosa. For the month of January 2017, production averaged 280 BOEPD, a 600% increase in daily average production. This production increase is due primarily to an aggressive work-over plan employing working capital committed by Molori to return non-producing wells to production, while keeping Lease Operating Expenses low due to tight cost controls and already established management.

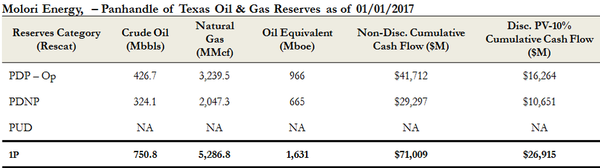

Further, the initial NI 51-101 dated April 1, 2016 resulted in USD$5.15 million of 1P (Total Proven Reserves) consisting of US$1.25 million PDP (Proved Developed Producing) and USD$2.89 million PDNP (Proved Developed non-Producing). The new updated NI 51- 101 dated March 08, 2017, effective January 2017 and prepared by Amiel David, Ph.D of PeTech Enterprises Inc, has resulted in USD$26.9 million 1P (Total Proven Reserves), a 420% increase, including USD$16.26 million in PDP and US$10.65 million PDNP. The resulting increase is a result of a successful work-over plan, and the fact that Ponderosa had as many as 10 work-over rigs employed during much of that time.

|

– Molori Interest is 25%

* Per BOE amounts have been calculated by using the conversion ratio of six thousand cubic feet (6 MCF) of natural gas to one barrel (1 bbl) of crude oil. The BOE conversion ratio of 6 mcf to 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of natural gas as compared to oil is significantly different from the energy equivalent of 1:6, utilizing a conversion on a 1:6 basis may be misleading as an indication of value. The ratio of gas to oil was 70% gas and 30% oil in June 2016 and 40% gas and 60% oil in January 2017.

Ponderosa and Molori have identified a development opportunity in the Red Cave formation. The formation is prevalent throughout its leases at a shallower depth of 2,100’ to 2,300’. Improved fracing technologies and completion techniques have demonstrated the Red Cave to be an economic development target. The Red Cave has been developed since the 1950’s but was not considered to be a high value target because of inadequate historical technology. Similar to the Permian Basin, new technologies have unlocked the reservoir to generate economic reserves and production in present day.

Molori has aggregated acreage in the play and will continue to add inventory in the coming months. After reaching further milestones in the Brown Dolomite reactivation strategy, the combined companies will test development to the Red Cave zone, which if successful, will add hundreds of economic drilling locations to the already robust inventory of PDNP wells.

Ponderosa, a domestic USA oil and gas production company, is the operator on the leases and is presently focused on aggregating and developing shallow, conventional oil reserves in Texas.

Ponderosa originally purchased these leases from distressed operators with highly-leveraged balance sheets and an inability to fund operations.

Molori and Ponderosa have chosen to collectively pursue assets which specifically exhibit the following properties: shallow reservoir, low geologic risk, moderate decline rates, and existing infrastructure.

The focus of Molori and Ponderosa’s activities has been in the “Hugoton-Panhandle” field in Northern Texas.

The Hugoton-Panhandle field, was the largest gas field in North America until the development of unconventional shale. The Anadarko Basin, which houses the Hugoton-Panhandle field, has produced over 125 trillion cubic feet of gas and 5.4 billion barrels of oil. Since the discovery of the Hugoton-Panhandle field in 1922, thousands of wells have been drilled to date. Due to the vast historical drilling and production data, there is a low geological risk associated with oil and gas development. The maturity of the field is crucial to Molori’s strategy of building reserves and resources, as decline rates are typically under 5% (year over year). Lastly, the liquids rich natural gas in this area, commands a premium over spot gas pricing. For these reasons, Molori is focused upon buying additional assets in this area.

In aggregate, Molori has a 25% interest in the approximately 250 wells purchased by Ponderosa. Molori Energy Inc is continuing to back Ponderosa as it fulfills its operational obligations in redeveloping non-operating wells and bringing them back into production.

For more info, check out their website: http://www.moloriener

???????

Recent "GROUNDBREAKING" Developments:

Molori Energy's Thompson 23-1R Well Flows Oil

Borger, Texas–(Newsfile Corp. – February 22, 2018) – Molori Energy Inc. (TSXV: MOL) (OTCQB: MOLOF) ("Molori" or "the Company") is pleased to announce a commercial oil discovery on its acreage in Moore County, Texas.

The "Thompson 23-1R" well, operated by Molori Energy, is a northern step-out well drilled in December 2017 where Molori Energy holds a seventy five percent (75%) working interest via its Thompson 26 and Thompson T2 leases. These leases directly adjoin to leases owned and operated by Adams Affiliates of Tulsa, OK, a successful operator and producer in the Red Cave trend. The Thompson 23-1R well is directly north of the active development area of Adams Affiliates.

As announced previously, he 23-1R well was completed on January 22nd, and was fractured with over 250,000 lbs sand and 340,000 gallons of slick water. The well has responded and produced on February 18th at 22 boepd*, 35 mcfd, and 61 bwpd for a blended production rate of approximately 28 boepd. The bulk of the water is load water which is consistently dropping with time, and the oil rate is steadily increasing with time. Peak production is expected within the next ten to fourteen days, following which Molori will be providing definitive results.

Furthermore, we have estimated that the reservoir pressure is 420 psia, which is consistent with original reservoir pressure in this area, and this location is not drained by offset production. The well log shows 100% oil pay with no gas cap. The log parameters are 37 feet of pay with 11.6% porosity with 39.8% Swi (Initial Water Saturation). These log results are very consistent with the near offset wells drilled recently by Adams Affiliates.

Commented Joel Dumaresq, CEO of Molori "We are extremely pleased with the 'discovery' and the initial results of our Thompson 23-1R well and frac into the Red Cave. The oil to water ratio continues to improve daily as we recover the water injected with the frac, and as a result we are experiencing daily increases in production."

Molori is expediting the installation of additional production tanks and moving forward with the continued development of its acreage in the area.

* Per BOE amounts have been calculated by using the conversion ratio of six thousand cubic feet (6 MCF) of natural gas to one barrel (1 bbl) of crude oil. The BOE conversion ratio of 6 mcf to 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of natural gas as compared to oil is significantly different from the energy equivalent of 1:6, utilizing a conversion on a 1:6 basis may be misleading as an indication of value. The ratio of gas to oil is 22% gas and 78% as reported.

CONTINUE READING THE FULL PRESS RELEASE HERE: https://www.newsfilecorp

If you didn't know, President Trump has had a PRO gas and oil agenda since he has taken office as he desires to push the U.S. towards a point of global dominance in the energy arena.

Another OVERSOLD indicator we can look at is the Williams %R. Barchart also tells us that MOLOF's 9-Day %R is at a silly oversold level of 99.51%!

(I am not guaranteeing that MOLOF will go flying to any previous high or beyond. To do so, would be irresponsible. Simply, I want you to be aware of MOLOF's potential upside through a thorough study of its technicals and chart.)

MOLOF could be a bouncer as it has on many occasions over the past year… Where could tomorrow's potential bounce take us?!?!

Take a close look at MOLOF'S CHART below immediately:

Do you see those short-term runs? Crazy, right? This play is an oversold ticking time bomb!

All you need to look at are a couple key ingredients to understand why this pick could be explosive! Study all of the OVERSOLD indicators like MOLOF's RSI and Williams %R, along with its chart history, and be prepared at tomorrow's bell!

Could this bounce play lead to our third consecutive win this week? I wouldn't bring this alert to your attention if I didn't think it had tremendous potential upside like my previous two runners!

AST

Disclaimer:

We have received three thsnd dlrs via a bank wire for the awareness of MOLOF

All of the information in this blog is gathered from public information released by the company.

By reading our newsletter you agree to the terms of our disclaimer, which are subject to change at any time. Owners and affiliates are not registered or licensed in any jurisdiction whatsoever to provide financial advice or anything of an advisory nature. Always do your own research and/or consult with an investment professional before investing. Low priced stocks are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service, you agree not to hold us, our editor's, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters, website, twitter, Facebook and chat. We do not advise any reader take any specific action. Our website, newsletter, twitter, Facebook and chat are for informational and educational purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter, twitter, Facebook and on our website, may be based on EOD or intraday data. We may be compensated for the production, release and awareness of this report. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. Our emails may contain Forward Looking Statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters, twitter, Facebook our website and chat is believed to be accurate and correct, but has not been independently verified. The information in our disclaimers is subject to change at any time without notice.

We are not held liable or responsible for the information in press releases issued by the companies discussed in these email's. Please do your own due diligence.

Any type of reproduction, copying or distribution of the material in this blog is prohibited without a written consent from the site owner.