JROOF – Jericho Oil Corp.

OK, I’m going to be short and to the point, as best I can. And I’m going to do it using three pictures… because, lets face it, it’s easier than reading 3000 words.

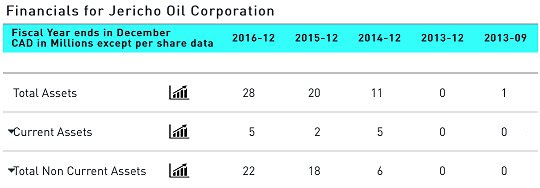

Over the past few days something jumped on the radar – something crazy – so we started to dig and what we found is something you need to see. First look at these two screen shots (keep in mind these number are in $millions CDN):

Pic 1)

This is a screen shot from Jericho Oil Corp’s (JROOF) last filing in Sept. 2017 showing assets of $38,970,918 CDN and liabilities of only $918,608.

It also shows JROOF has over $13.3 Million CDN (about $10.4 Million USD) in Cash!

And…

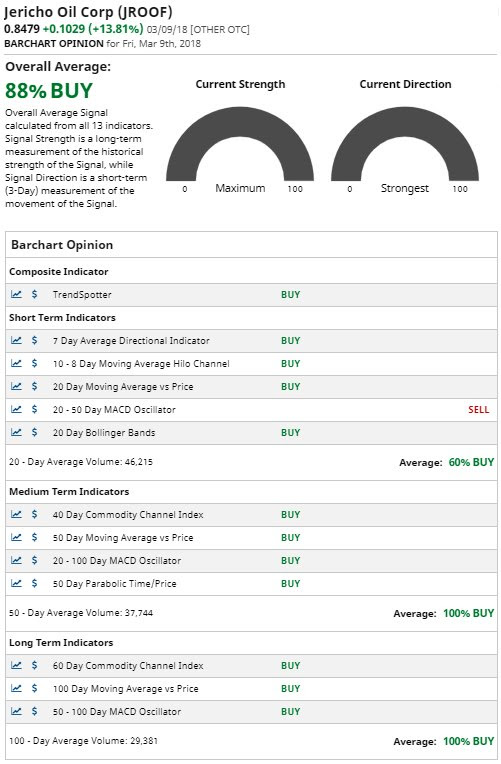

Pic 2)

This is the asset growth for Jericho Oil Corp (JROOF) from $1 Million CDN in Q3 of 2013 to $28 Million CDN in Q4 2016.

As you can see, these figures are Canadian dollars as JROOF is based in Canada with operational headquarters based in Tulsa, Oklahoma.

Using current conversions these figures in USD are:

– Assets in Sept. 2013 of about $780K USD

– Assets in Sept. 2017 of $30,417,970 USD

So, umm… holy cow… that’s asset growth of 3,799%!

Understating these figures could be the key to unlocking something big, so be sure to complete your own research on JROOF as soon as possible, because…

…Over the last few days JROOF has been, to put bluntly, going nuts. Over the last 5 days JROOF’s average volume is 124K, more than 3.5x its 30-day average.

Why is it going “nuts”?

Maybe it’s the recent (see the March 5th WSJ article below) International Energy Agency (IEA) statements stating:

U.S. Will Be the World’s Largest Oil Producer by 2023, Says IEA

As the article states:

“Influence on global oil markets is also expected to rise, with U.S. oil exports more than doubling”

Perhaps it’s recent news (see news release link further down in this report), or it could simply be that more and more people are starting to learn about this rising oil & gas star.

Whatever the reason, recent activity shows JROOF gaining traction of late, while putting up multiple green days.

Here’s the third and final picture, saving you yet another 1000 words of reading and showing you what you missed if you didn’t click on the Barchart indicator link above:

With all those Bullish indicators, a positive outlook from the IEA about the future for gas and oil production/exportation growth within the US, jaw-dropping growth that has the company reporting over $30 million in assets, and a recent spike in activity…

…JROOF is just about demanding attention right now, so get started on your research right away.

JROOF is also trade on the TSX-V in Canada, symbol “JCO”.

Website: www.jerichooil.com

Quote: https://www.barchart.com/

InfoGraphic Presentation: https://jerichooil.com/

Corporate Presentation Jan. 2018: https://jerichooil.com/

Jericho Oil is based in Vancouver, British Columbia, with operational headquarters in Tulsa, Oklahoma. Jericho is focused on domestic, liquids-rich unconventional resource plays, located primarily in the Anadarko basin STACK play of Oklahoma.

Jericho assembled a 55,000 net acre position across Oklahoma, including an interest in 14,000 net acres in the STACK play.

Jericho’s current operations are focused on the oil-prone Meramec and Osage formations in the STACK. The Jericho team applies advanced engineering analyses and enhanced geological techniques to under-developed resource areas.

JROOF recently announced the company entered into a new Farm-In Agreement, enabling Jericho to:

“The Farm-In Agreement and joint development of the Major County STACK assets will allow Jericho to (i) strategically grow its STACK acreage position by approximately 30% at a discount to recent STACK transactions; (ii) participate in the drilling of multiple horizontal wells targeting the prolific Osage formation; (iii) continue to aggregate critical drilling, completion and lateral placement data; and (iv) cost effectively grow production and potentially reserves.”

See the news here:

Jericho Oil Announces Farm-In Agreement; Option Increases STACK Acreage Footprint By 30%

Jericho Oil Corporation’s primary business objective is to drive long-term shareholder value through the growth of oil and gas production, cash flow and reserves.

So exactly how do they plan on accomplishing this objective?

– Repeatable and Consistent Acquisition and Development Strategy

– Identify Fractured and Dislocated Markets and Opportunities

– Uncover Additional Optionality through Stacked-Pays and Other Efficiencies

To be more specific, the company has identified basins located within the Mid-Continent which have experienced the most severe capital flight amid the precipitous drop in the price of oil. JROOF believes pervasive capital accessibility has the ability to veil the true economic and repeatable viability of drilling oil and gas reserves.

In fact, they even have an equation for maximizing their success:

Buy Orphaned Assets for Pennies on the Dollar

+ Apply Modern Technology and Techniques to Underperforming Assets

= Realize the Long-Term Intrinsic Value of these Assets through Operations

JROOF has be calculated in their approach to building an impressive portfolio of undervalued and overlooked oil and gas properties, taking advantage of a massive sell-off and paying pennies on the dollar for prime development opportunities.

With news that the oil and gas market could be ready to climb once more JROOF may just be in the perfect position to capitalize.

We first looked at JROOF back in November at 0.5960.

It is currently up more than 42% from that level.

JROOF could be the “total package”:

– Bullish indicators

– Potentially favorable market conditions

– Positive IEA future outlook of US based O&G for production/exportation

– Amazing asset growth

– Reporting over $30 million in assets

– Recent spike in activity…

You certainly want to put JROOF on your watchlist now and have it on your screen tomorrow morning.

Remember, we always encourage you to do further research. Never take our word for it, read our disclaimer to see why, and of course always consult a professional. Just because a situation looks great things can still go wrong and often do.

Sincerely,

AST

Disclaimer:

To date we have received sixty five thsnd dlrs via a bank wire for the awareness of JROOF

All of the information in this blog is gathered from public information released by the company.

By reading our newsletter you agree to the terms of our disclaimer, which are subject to change at any time. Owners and affiliates are not registered or licensed in any jurisdiction whatsoever to provide financial advice or anything of an advisory nature. Always do your own research and/or consult with an investment professional before investing. Low priced stocks are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service, you agree not to hold us, our editor's, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters, website, twitter, Facebook and chat. We do not advise any reader take any specific action. Our website, newsletter, twitter, Facebook and chat are for informational and educational purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter, twitter, Facebook and on our website, may be based on EOD or intraday data. We may be compensated for the production, release and awareness of this report. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. Our emails may contain Forward Looking Statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters, twitter, Facebook our website and chat is believed to be accurate and correct, but has not been independently verified. The information in our disclaimers is subject to change at any time without notice.

We are not held liable or responsible for the information in press releases issued by the companies discussed in these email's. Please do your own due diligence.

Any type of reproduction, copying or distribution of the material in this blog is prohibited without a written consent from the site owner.